Really weird to read that one can actually make money using credit cards! You must be getting advice from your parents, friends and your colleagues on credit cards, such as, don’t use credit cards, avoid taking a credit card, and it is not a wise decision if you are paying any bill through a credit card.

The more you use credit card, the lower your credit score, and these factors can impact your Cibil score. There are many factors which can conclude that Credit card is not a good option for paying or easy access to money.

1. High Interest Rate – If you do not pay your credit card bills on time, a heavy interest rate will be applicable.

2. Hidden Charges – Apart from the interest charges, there are many hidden charges like late payment fees, annual fees, renewal fees and processing fees.

3. Overuse of credit card – It’s a human tendency to overuse if you have easy access to money, credit card is one of the main reason of overuse.

4. Credit card scam and frauds – There have been many scam and fraud cases related to credit card leading to a financial loss.

Since credit cards are always used to pay money? How do we earn money from these credit cards?

There is one unique application which is there for credit cards, this application can help you to earn a good amount from credit cards. The application name is CRED, this application is readily available on Google play store and App store.

CRED

What is CRED?

CRED is a mobile based application which is used to clear credit card bills. If you have multiple credit cards, you can pay the bill payments of all credit cards from a single place. This app will basically help the credit card owner to manage multiple cards through one source, and that source is CRED.

Features of CRED applications are,

- Cred application will let you pay your credit card bills.

- Earn CRED Coins for every credit card bill.

- Redeem CRED coins on rewards, upgrades and cashback.

- CRED app can keep a track of spend analysis and efficieny of card usage!

How to register yourself with CRED?

As stated earlier, the application is available in both application store, Google Play Store and Apple Store. Signup is very easy, just visit the application from your app store, install and start using it.

The end user rating of this app is 4.8 in Apple store and 4.7 in Android app store.

Benefits of using CRED?

- You will never miss your credit card due dates.

- Awesome rewards, collect CRED coins and use these coins to take offers and rewards.

- You will get mail and call notifications if any of your credit card is pending for payment.

- Rewards can be in a from a cup of tea or a flight ticket.

- Hidden charges on your credit card are disclosed.

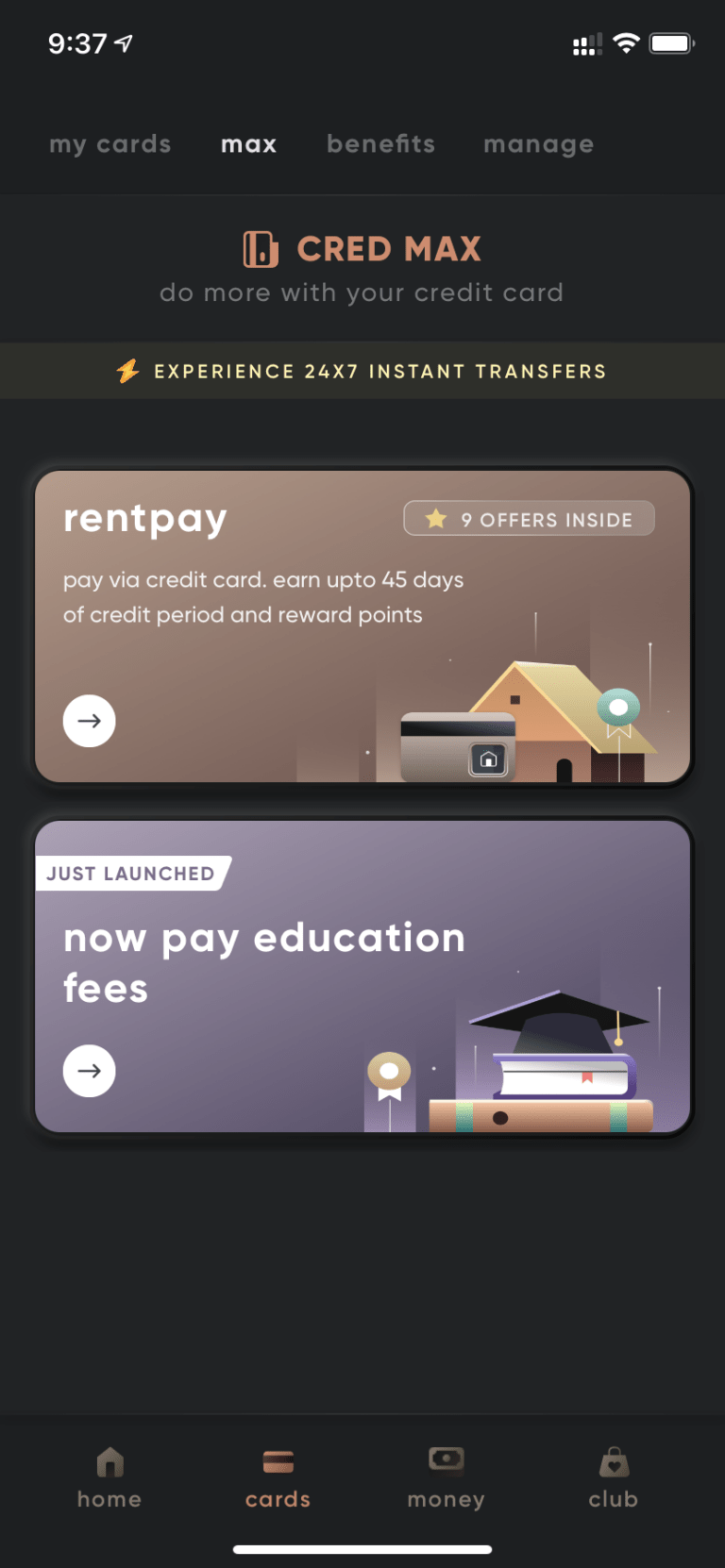

Features of CRED APP

- Using CRED app you can pay your home rent, either you can pay it from your credit card, debit card, UPI or any other source.

- CRED Education fees is a new feature that enables you to pay school fees, and tuition fees using credit card.

- CRED app has a feature with name CRED Track, CRED track helps you easily fetch and check the balance on all your bank accounts on CRED.

- CRED’s referral program lets you invite friends to join CRED and get rewarded for it! Once your referral has registered successfully and has made their first credit card bill payment of at least 100rs on CRED, you and your friend receives 10 gems to claim exclusive rewards.

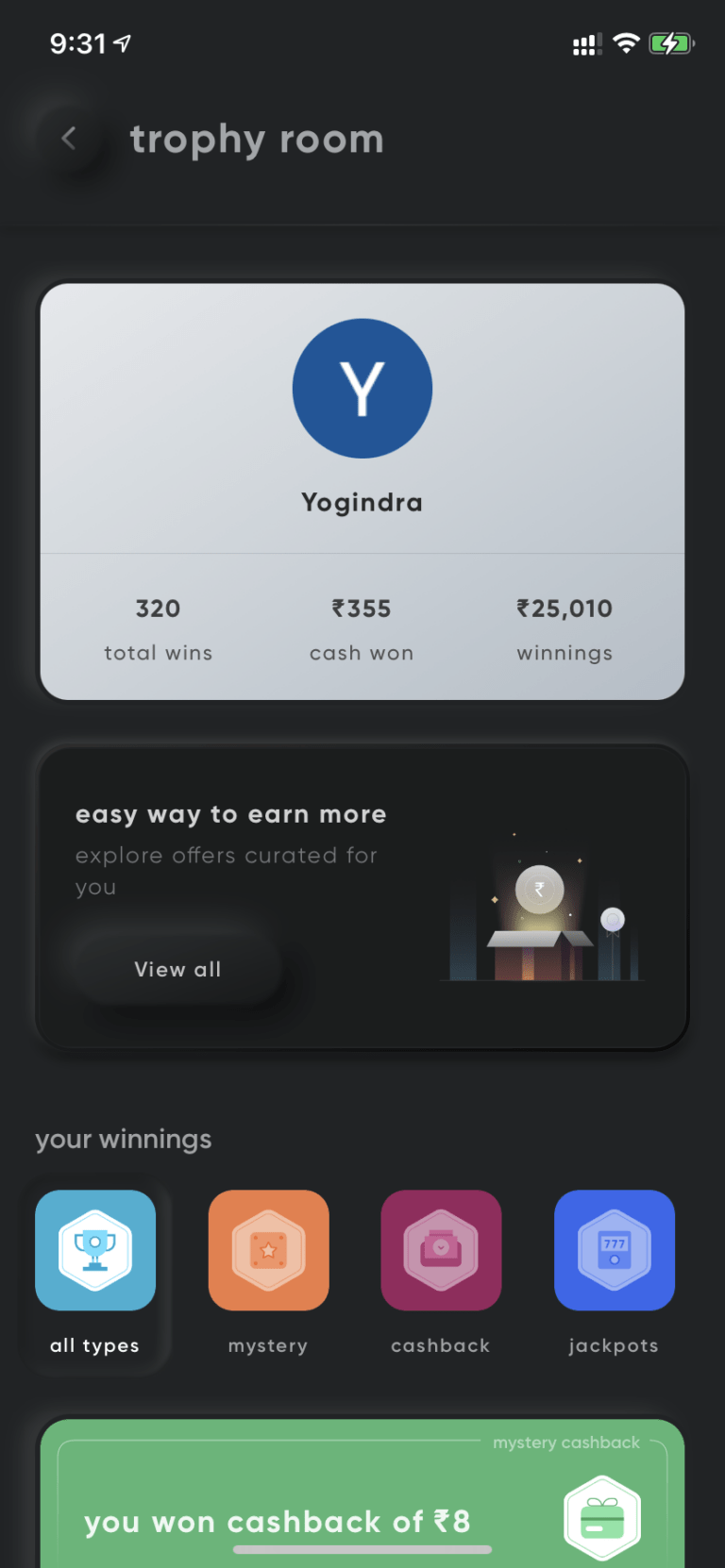

Rewards

There are different types of rewards like mystery rewards, raffles, arcades, skill games, jackpots or action-based rewards. You can also unlock mystery cashback rewards when you clear your credit card bills and refer friends to CRED.

You can find all the prizes, you have won in the rewards section in the ‘Trophy room‘. The total cashback you have won is displayed at the top of the trophy room as “cash won“. “Winnings” is the approximate value of all your winnings, including cashback, vouchers and other prizes that you have won in “rewards“

Though Credit cards are not recommended, but if you are earning a good amount of money from your credit card using this app, then why not give a try! There is no harm in it. If you are lucky, Rewards can be very much bigger, in fact you can even become a millionaire overnight.

I am not joking, i am serious!

Last year, a CRED app user won a Mercedes GLC card worth thousands of dollars. Click here to get more details.

FAQ

How can I use credit cards to make money?

- GET MONEY WITH CASH-BACK CREDIT CARDS.

- EARN BONUS REWARDS POINTS.

- INVEST YOUR CASH BACK.

- SELL YOUR REWARDS POINTS – BUT BE CAREFUL.

- DO YOUR SHOPPING ONLINE.

- JOIN ACORNS AND LINK A CREDIT CARD.

- GET CREATIVE WITH EXPIRED CREDIT CARDS.

How do you use a credit card cleverly?

- Keep an eye on your spending.

- Set an ideal credit limit.

- Check Credit Card statements regularly.

- Use free offers and rewards.

- Pay Credit Card bills on time.

- Avail of easy loans.

- Opt for Contactless Credit Cards.

- To sum up.

Do credit cards give you money?

Depending on the card, cash back credit cards can reward everyday spending on things like groceries, gas, dining and entertainment. For every qualifying purchase, you earn back a percentage of what you spend. And then you can redeem those rewards in various ways, depending on the card issuer.

What is the average 20 29 year old’s credit score?

The average FICO score for people between 20 to 29 years old is 663. You’ll probably start this decade with a “thin file” at the credit reporting bureaus.